The report focuses on benchmarking Dubai against the seven other key global cities, across key sectors of: healthcare, manufacturing & logistics, business & financial services, tourism and education.

This week’s release looks at the development of one of Dubai’s most important sectors: Healthcare.

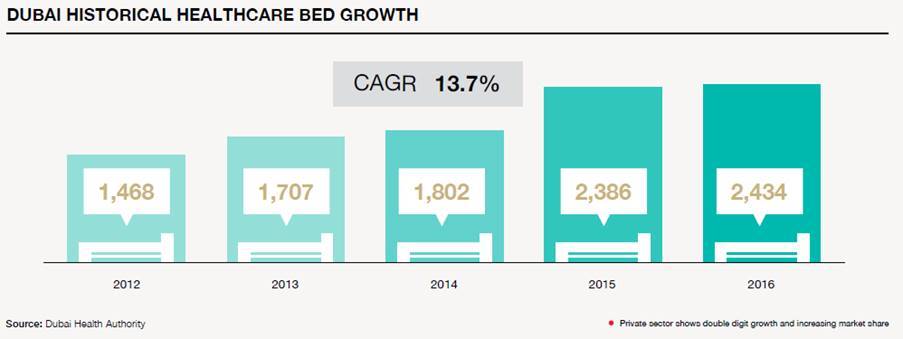

The increase in demand for healthcare services over the past 10 years was spurred by: population growth (6% year on year), increase incidence of life style related medical conditions and medical tourism. The Government is supporting this growth by creating an investor friendly environment, ensuring transparency, establishing a healthcare free zone and introducing mandatory insurance to name a few initiatives. Over the last five years, the knock on effect of these changes has resulted in the number of hospital beds increasing from 1,448 in 2012 to 2,434 beds in 2016, registering at CAGR of 13.7% and shifting contribution by the private sector from 41% to 53% over the same period.

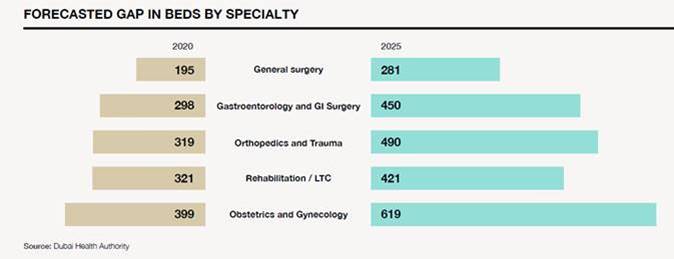

Shehzad Jamal, Partner Development Consulting: Healthcare & Education commented: “The market is becoming increasingly sophisticated and speciality driven due to higher degrees of awareness in the domestic market and medical tourism demand. As a result, the market is seeing a shift in demand from general hospitals towards specialty hospitals, such as orthopaedic, long-term care facilities and mother and child. Prominent examples of such facilities are Burjeel Hospital for Advanced Surgery and Medcare Women and Child Specialist Hospital.”

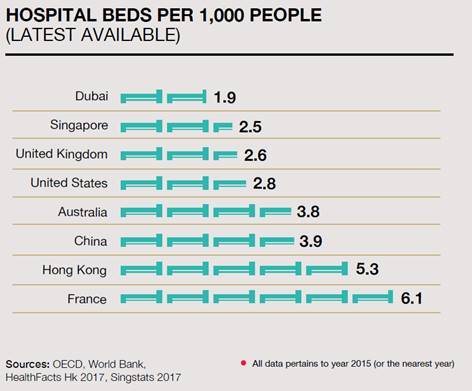

Comparing Dubai in terms of number of beds per 1,000 population with developed countries (especially those that have had a strong medical tourism focus such as Singapore, UK and USA) we see that there is significant potential for growth for the healthcare sector.

Beds per 1,000 people

Dubai’s demand growth is driven by:

- Expatriates are staying in the UAE for longer periods than originally intended, and are relocating their families to benefit from the lifestyle that Dubai offers.

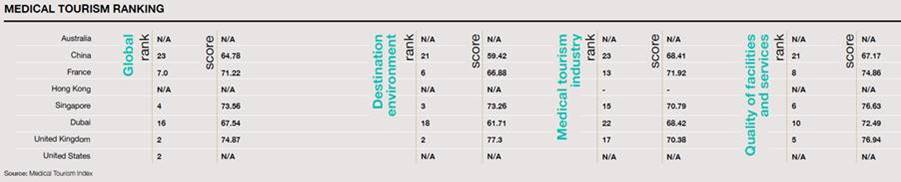

- As per the medical tourism index, Dubai continues to strengthen its position as a medical tourism destination, ranking globally in 16th position and 1st in MENA region. By 2020, the emirate is targeting 500,000 medical tourists from 325,000 in 2016 representing a CAGR of 11.3%.

- Medical tourism destination rankings for Dubai:

- Quality of services: 10th globally

- Destination environment: 18th globally

- Medical Tourism industry: 22nd globally

Medical Tourism Ranking

The outlook is that market demand will continue to grow and will migrate towards more specialist healthcare facilities, the chart below presents the forecasted gap in beds by speciality.

Dr. Gireesh, Senior Manager Development Consulting: Healthcare, commented “There remains a dearth in preventive healthcare services catering to the growing volume of life style diseases such as diabetes, obesity and hypertension and the associated co-morbidities such as renal and cardiovascular diseases among others. Patients awareness has increased over the years owing to increased availability of information and smart healthcare systems such as smart watches and applications. Going forward the healthcare sector will witness a shift from reactive to proactive healthcare increasing the demand for preventive medicine facilities.

Click here to download the report.

For further information, please contact:

Nicola Milton, Head of ME Marketing, +971 4 426 7000, Nicola.milton@me.knightfrank.com